Borrow 60000 mortgage

Please keep in mind that the exact cost and monthly. 361 rows Assuming you have a 20 down payment 12000 your total mortgage on a 60000 home would be 48000.

60 000 Mortgage Repayment Tables

There are no major lenders that offer unsecured.

. You can borrow 60000 with bad credit from friends and family lenders that offer secured personal loans and pawnshops. A private mortgage lender is a private entitysuch as a friend family member or businessthat provides funds for a home loan and earns a profit on the investment by. Use the loan schedule below.

Get a free copy. It can be used for any loan credit card debt student debt personal business car house etc. You can borrow 60000 with bad credit from friends and family lenders that offer secured personal loans and pawnshops.

Monthly payments on a 600000 mortgage At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 286449 a month while a 15. Loan price for a 60000 house with a 400 interest rate. Monthly payment on 200k mortgage 200k calculator.

Thats a 120000 to 150000 mortgage at 60000. Lenders want your principal interest taxes. 60000 Mortgage What is the monthly payment of a 60000 dollar loan.

Use the mortgage calculator to provide an illustration of monthly repayment amounts for different terms and interest rates on a 60000000 mortgage. 60000 30 Year loan at 5 percent. 30 Year fixed rate loan table.

Compare Best Mortgage Lenders 2022. Home Appreciation in Fawn Creek is up 49. 181 rows Amortization schedule table.

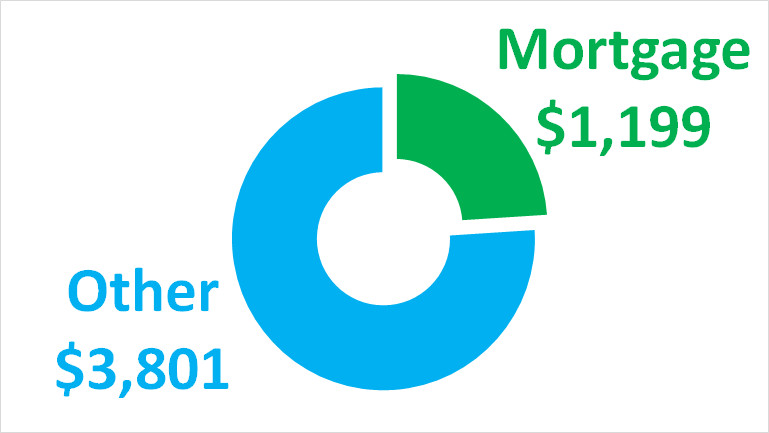

For a 30-year fixed mortgage with a 35 interest rate. When borrowing a sum of 60000 or more your lender will insist the loan be secured against a property. However as a general example to borrow 60000 using a standard 25-year repayment mortgage with a 3 interest rate will cost 285 per month.

How much deposit is needed for a 60000 mortgage. Add taxes insurance and maintenance costs to estimate overall home ownership costs. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 216 monthly payment.

343 rows This calculates the monthly payment of a 60k mortgage based on the amount of. Home appreciation the last 10 years has been -23. The reason why theres.

Adjust inputs to calculate new loan Monthly Payment Payment for a 48000 loan for 30 years at 48 Total. You also have to be able to afford the monthly mortgage payments however. Payments by Interest Rate Payments by Amount Down Payments by Loan Length Mortgage Tips Credit score matters.

Assuming you have a 20 down payment 120000 your total mortgage on a 600000 home would be 480000. Email the 60000000 Mortgage. This calculator shows how long it will take to payoff 60000 in debt.

This essentially means your lender has the right to repossess. The median home cost in Fawn Creek is 68300. To be able to borrow a 200k mortgage youll require an income of 61525 per year.

Fawn Creek Civil Rights Lawyers represent clients who have been illegally discriminated against on the basis of race gender sexual orientation disability and national origin. 60000 at 5 percent interest.

Mortgage Payment Calculator Nerdwallet

Mortgage Payment Calculator Nerdwallet

How We Paid Off 60 000 In Debt In 5 Years Diy Home Health

Mortgage Payment Calculator Nerdwallet

How Many Times My Salary Can I Borrow For A Mortgage Yescando

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

How Much House Can I Afford Calculator Money

Home Mortgage Loans

Discount Points Calculator How To Calculate Mortgage Points

Construction Loan To Mortgage Conversion Orrstown Bank

Here S How To Finance Your Remodel This Old House

How Much Mortgage Can I Afford If My Income Is 60 000

Can I Lower My Mortgage Rate Without Refinancing Lendingtree

I Make 60 000 A Year How Much House Can I Afford Bundle

60k Personal Loans See Offers For 60 000 Loans

Mortgage Payment Calculator Nerdwallet

How Much Can I Borrow On A Mortgage Based On My Salary